National Conference on Teacher Policy in Costa Rica

Workshop that seeks to promote debate on teacher policy and showcase innovative policies.

This blog post examines sending costs to eight Latin American and Caribbean countries and finds, first, that using pricing data from the leading companies performing the majority of transactions if not 90 percent from the US to these elected countries, the average cost of sending is 4 percent of the principal amount. But when paid in US dollars, it drops to 3 percent. One of the important considerations about an analysis of costs reflects the most important reality shaping the money transfer intermediation industry, which is that is tied to a global currency market, where currency values shape the weight of a transaction’s price. The talk about the high transaction costs of remittances continues in different forums, and still despite elegant statistical modeling in some cases, is uninformed, and moralistic or with spurious correlations.

Sending money costs like anything else, and the percent cost relative to the amount ‘bought’ is often criticized without proper benchmarking. Some refer to average costs without considering the basic weights that the average consumer considers, such as: the sending vehicle (cash, bank account transfer, credit card); payment in US dollars only, and deposited into a bank account or cash pick up. What is more problematic is that remittance transfer companies are often held to a standard that is not justified by any procedure – the 3 percent benchmark.

Second, differences in exchange rate offerings vary across companies and remittance service providers. However, when compared to the exchange rate offered by leading financial institutions in each country, the average RSP exchange rate is not so different from that of the financial institution. That means that there is no gauging or speculation with the currency. There is simple competition. In countries where margins are above 1 percent, exchange rate margins are high among other financial service providers, too.

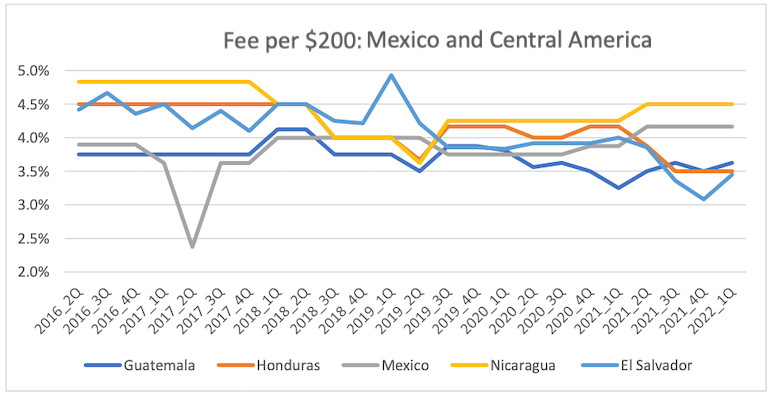

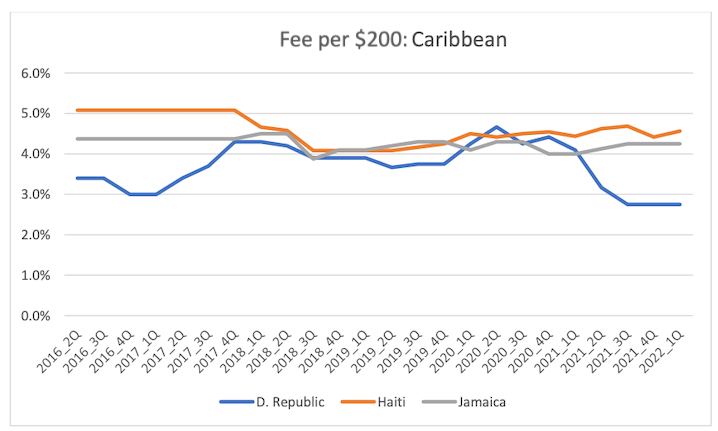

Third, the real cost – the amount people pay according to the actual amount – not the reference amount, is below 3 percent, and fourth, despite differences in how the World Bank measures cost (including companies with little or no presence in money transfers, averaging all costs regardless of payment instrument, for example), fees have dropped despite inflation in the United States.

1. About Money Transfers and Intermediation

Family remittances are connected to a marketplace of intermediation for transfers. The transferring process is treated as a commodity for which a service is provided to ensure an amount of money is delivered from one point of origination to its destination. This process connects with development at various segments, including regulations, competition, and financial inclusion. Remittance transfers are shaped by rules and the existing marketplace that intermediates the transactions—particularly a global competitive foreign currency market to which companies try to get the most acceptable values. These rules as well as supply and demand in this remittance marketplace significantly shape the transfer process.

The migrants’ share of income occurs in the form of a transaction of money in exchange for money to be delivered to a relative. Immigrants buy [foreign] currency to send to relatives at a certain price. In this context, money is treated by the market as a commodity, or a good for which people have a demand. The purchase of such currency is competed and regulated through legislation pertaining to foreign currency controls of different kind (authorized entities, financial crimes, consumer protection, sovereignty). These rules are one component of the transfer process, as intermediaries must deal with different issues relating to development.

Other aspects of the money transfer include, the legal position of the transfer (licensed or unlicensed), the sending methods (cash or account), the mechanisms utilized (front-end technology or ancillary tools), the extent of competition in the origin by remittance sending providers and the destination by payers (banks exchange houses, microfinance institutions, etc.). In addition, there are value added elements in the transfer, such as its leveraging potential for migrants to achieve financial access.

When looking at intermediation, one issue that has been raised in the international community is transaction cost as an expensive and inefficient payment process. The argument has been made that transfer costs are expensive. However, to truly understand whether transaction cost matters in remittance transfers is important to assess the role of intervening factors.

The expensive nature of these costs is not a function of business speculation but rather of a mix of challenges. Specifically, some of these challenges pertain to culture (home delivery, cash originated and received transfers), regulations (pertaining to compliance to financial risk mitigation), competition in the transfer origination and destination, extent of informal networks, economies of scale on the origin or destination, and business operating costs (including direct costs such as electricity, or cell phone data in some countries).

2. Average Sending Costs To Selected Countries in August 2022 for US$200

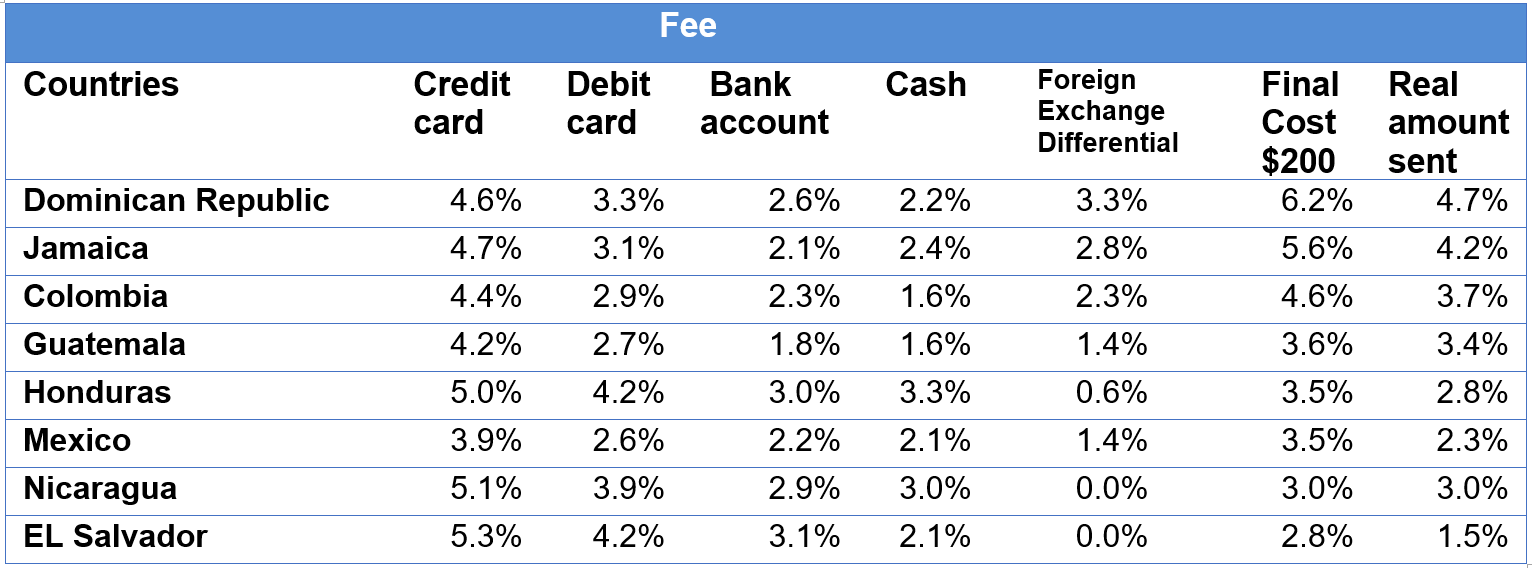

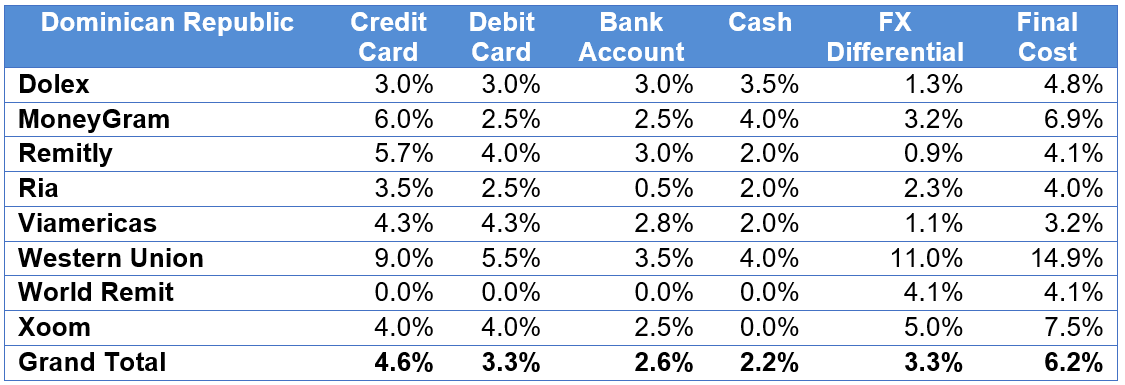

The average for all countries for which numbers were gathered is four percent with variations from 2.8 percent to 6.2 percent to the Dominican Republic. There are differences in the fee charged depending on the payment instrument employed. The table below reflects the cost of transactions by companies that do cash or digital/online transactions—it weighs the share of transactions performed in both methods. The last column is based on the real amount sent and the cost incurred to it.

Table 1: Sending Costs to Selected Countries by Sending Method and Exchange Rate

|

3. Foreign Exchange Margin or Differential

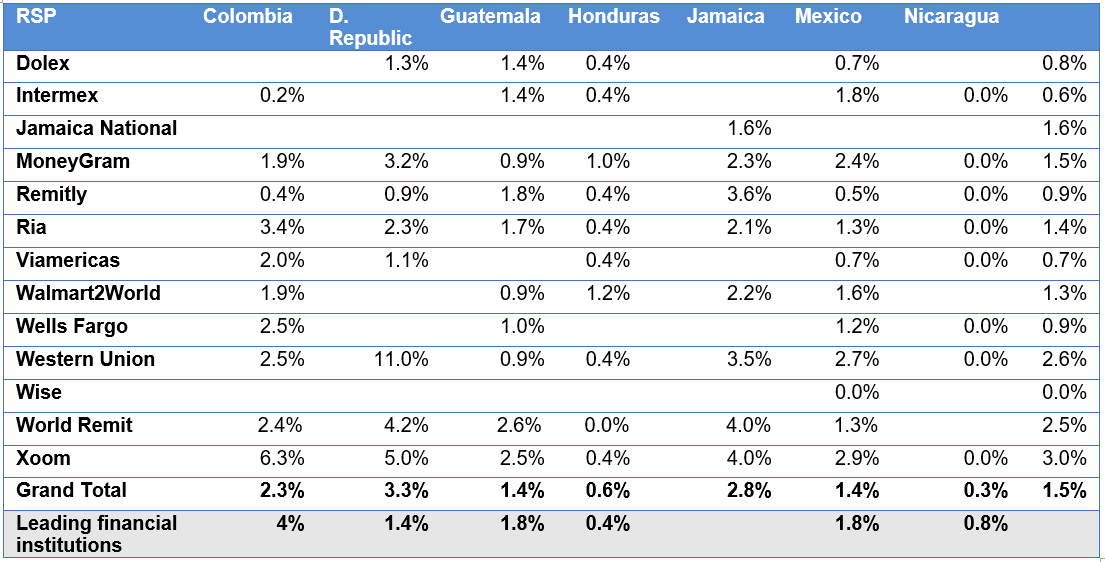

The data collection and analysis included a look at the foreign exchange margin between the rate offered by the and that of the interbank rate. There are variations across companies on the date the data was collected. The IAD revisited some of the rates on various occasions for companies when the margin was larger than average to control for outliers. However, it is important to note that the exchange rate margin among private financial institutions is as competitive or less than that offered by RSPs.

Table 2: Foreign Exchange Margin

|

*The exchange rate offered by leading financial institutions in each country was compared with their differential to the RSPs’ and it was found that overall variations are smaller for RSPs, except with the Dominican Republic.

4. Fee Differences by Country and RSP

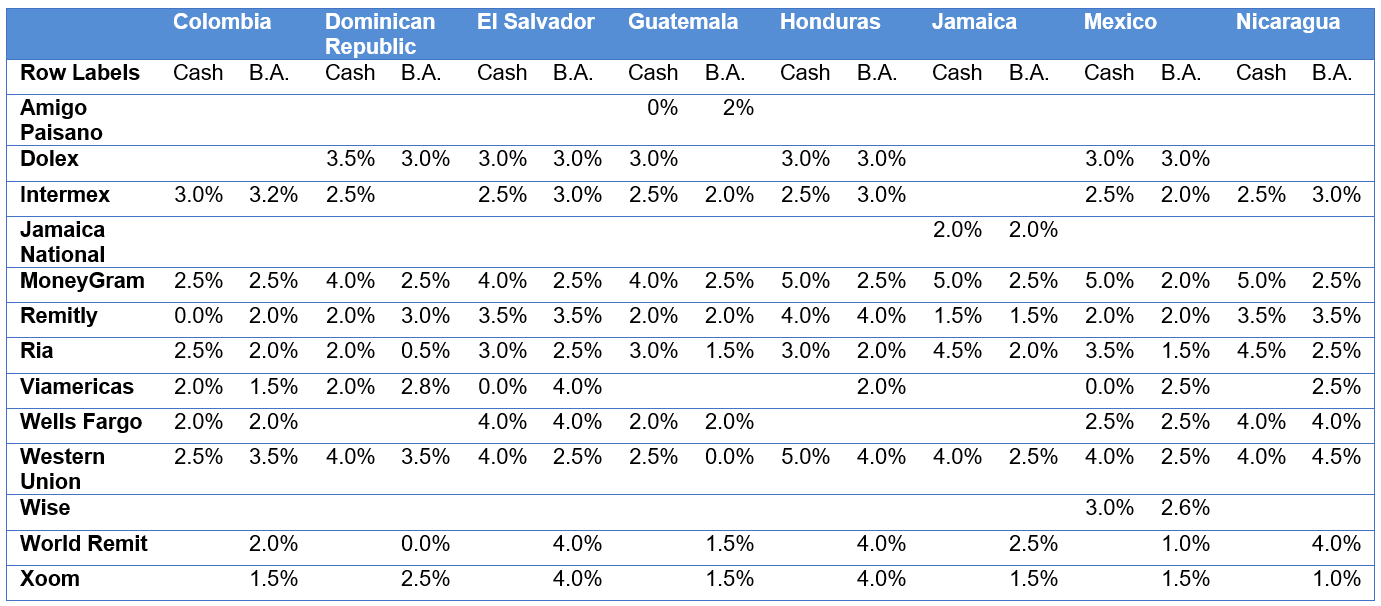

This table provides the breakdown of fees by company. For the most part, fees as share of principal are under US$7 on average.

Table 3: Fees by Company

|

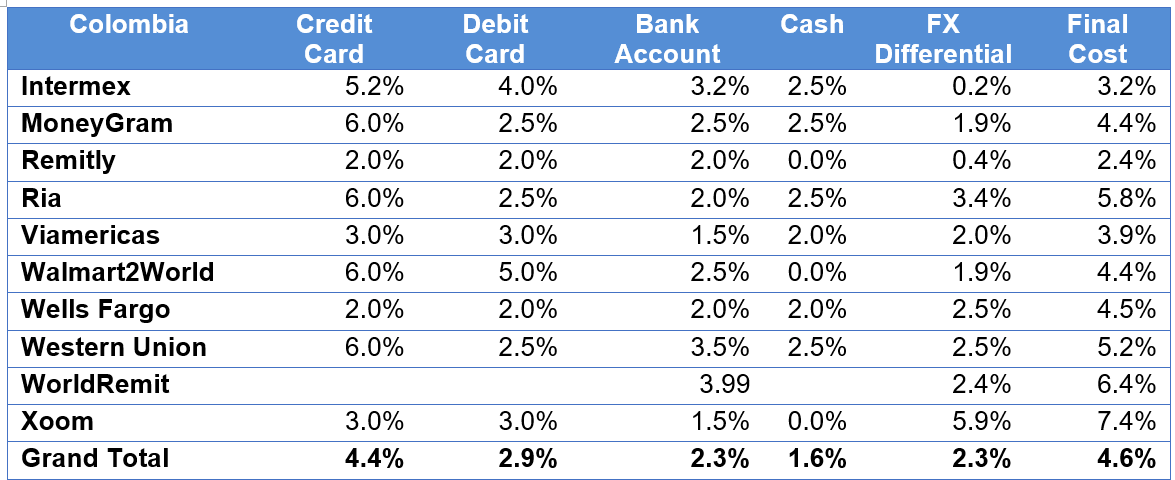

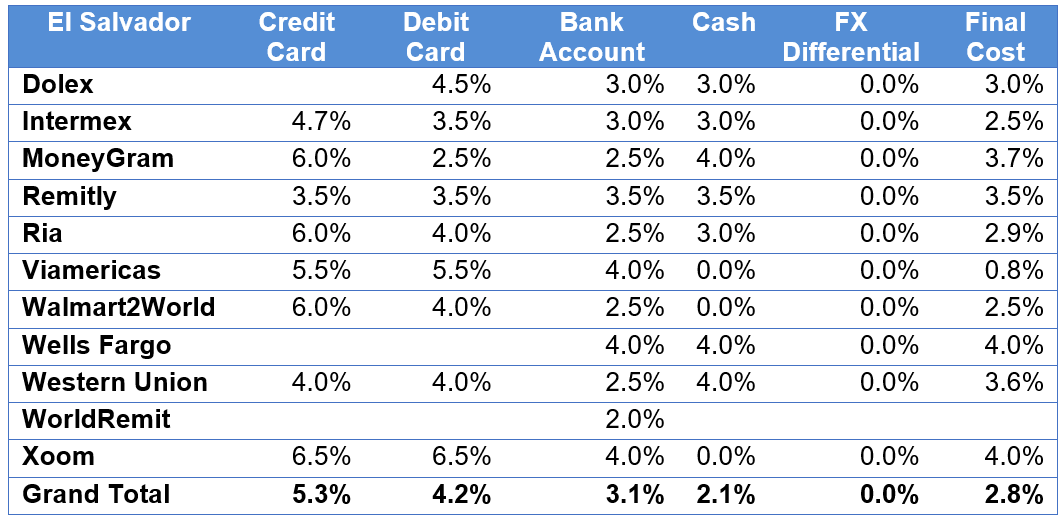

5. Cost by Country and RSP, August 2022

Table 4: Cost by Country

|

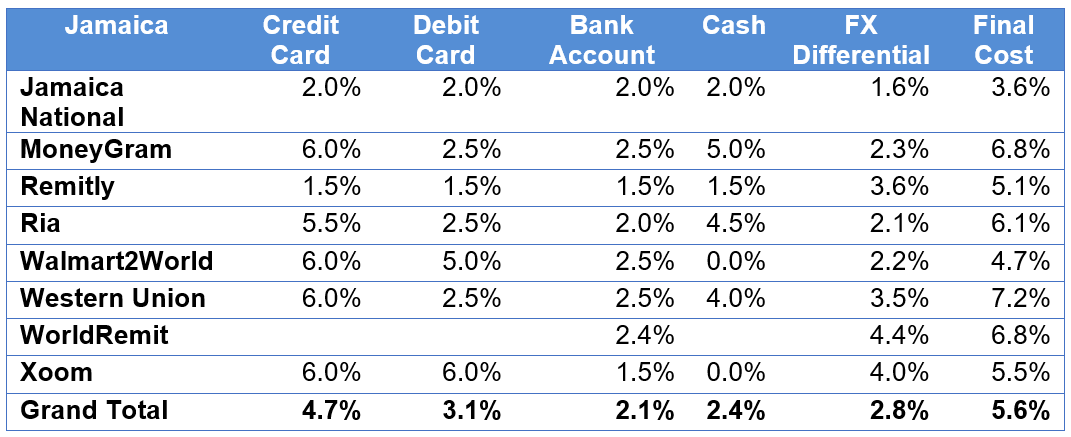

Table 4.1: Cost by Country

|

Note that 70 percent of transactions to the Dominican Republic are in US dollars, therefore, the ‘true’ cost is that only provided in the fee per transaction.

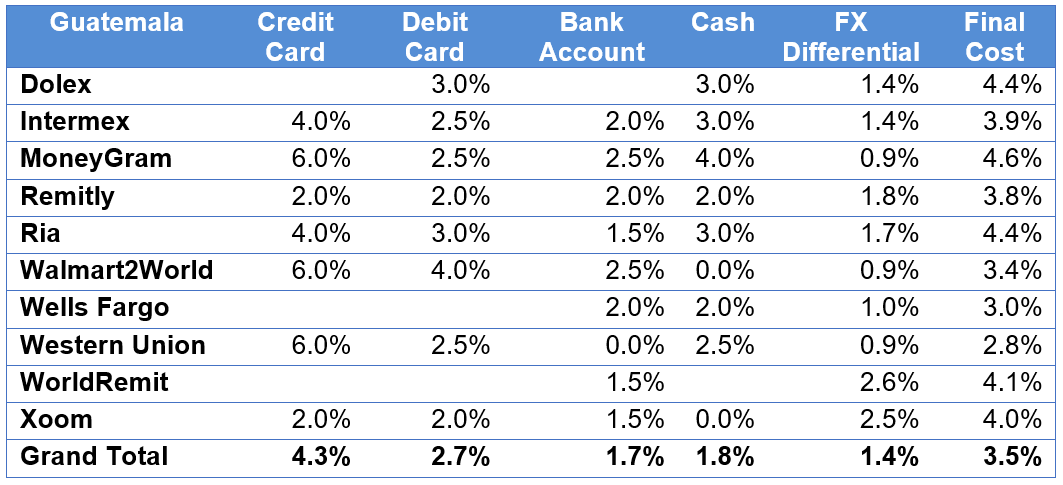

Table 4.2: Cost by Country

|

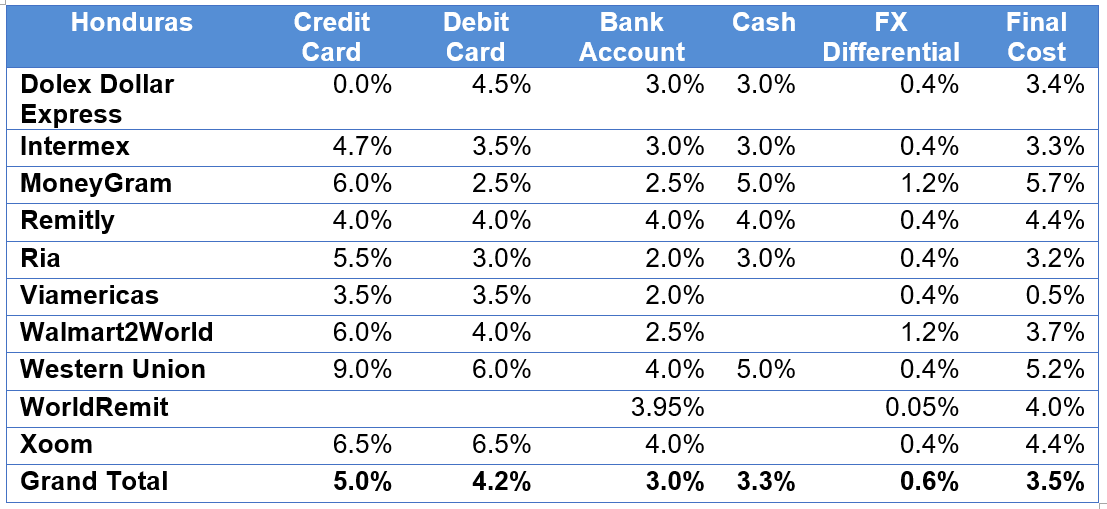

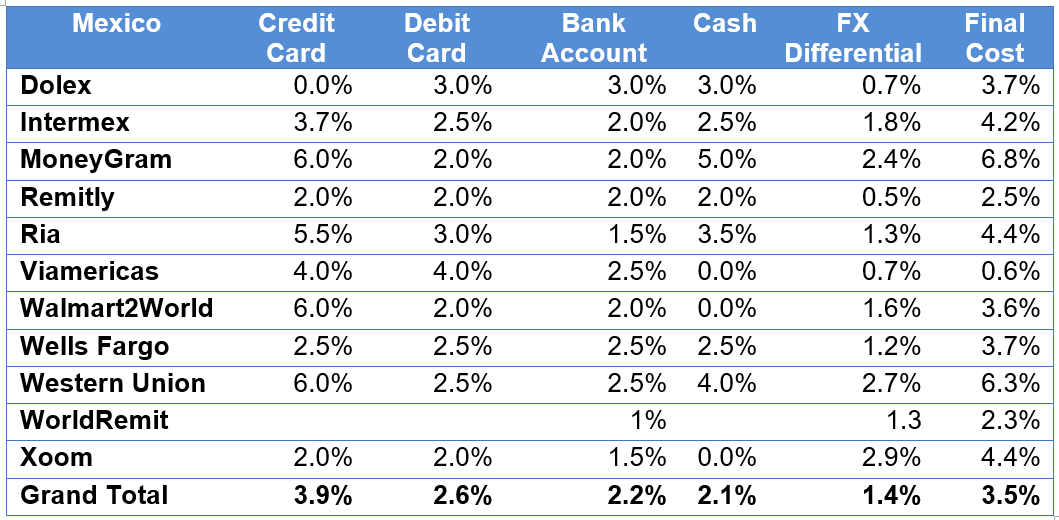

Table 4.3: Cost by Country

|

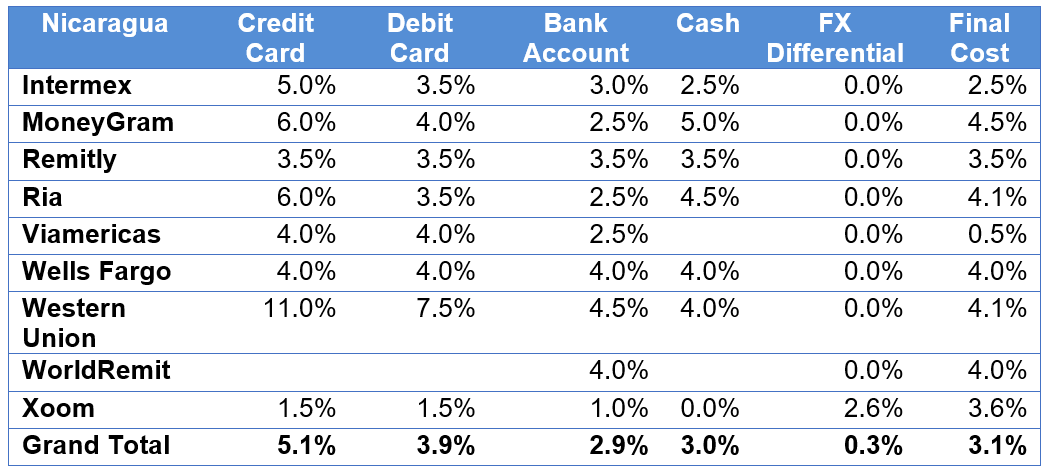

Table 4.4: Cost by Country

|

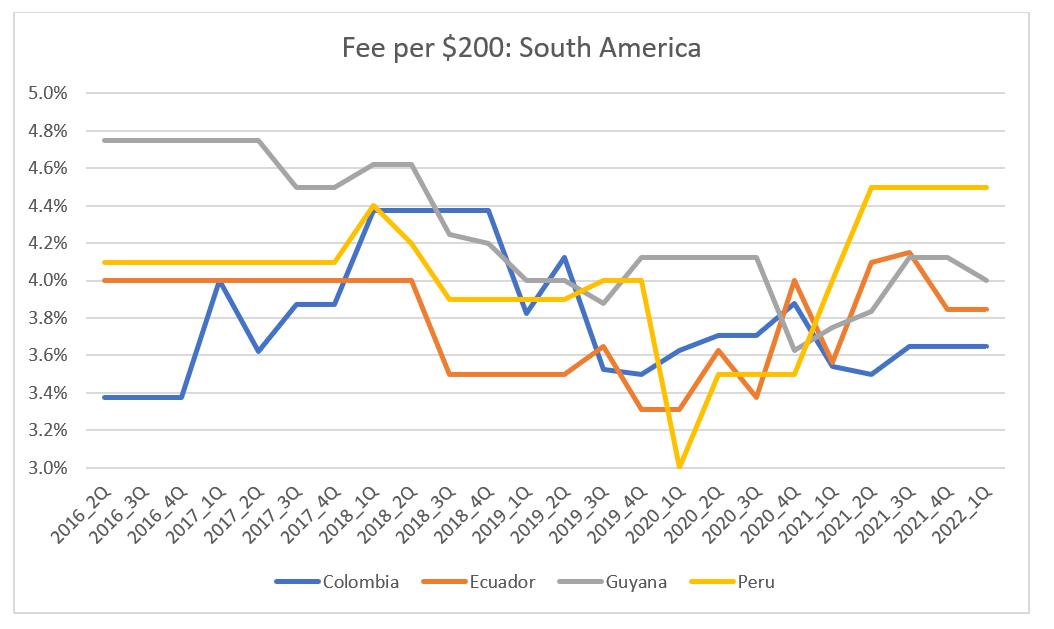

Table 4.5: Cost by Country

|

Table 4.6: Cost by Country

|

Table 4.7: Cost by Country

|

The World Bank Numbers

The following are World Bank pricing tables of their unweighted averages.

Table 5: Pricing Tables

|

Table 5.1: Pricing Tables

|

Table 5.2: Pricing Tables

|

Appendix

The cost review looked specifically at 12 money transfer companies, which together manage more than 80 percent of transfers. The cost figures were collected between August 4 and August 20, 2022:

|

Migrant Remittances to Central America and Options for Development

Why Do Remittances to Mexico Continue Breaking Records?

Interpreting Increased Remittances to Latin America and the Caribbean

Workshop that seeks to promote debate on teacher policy and showcase innovative policies.

PREAL reviews broad spectrum of its activities and discusses priorities for improving education policy in the coming year.

Progress of Latin American countries and the Caribbean towards the six Education for All goals.