The Politics Of Disaster Relief

After a 7.0 magnitude earthquake struck Haiti, the aftershock reached China in ways that few anticipated.The earthquake forced Chinese leaders to navigate the tricky politics of disaster relief.

A Daily Publication of The Dialogue

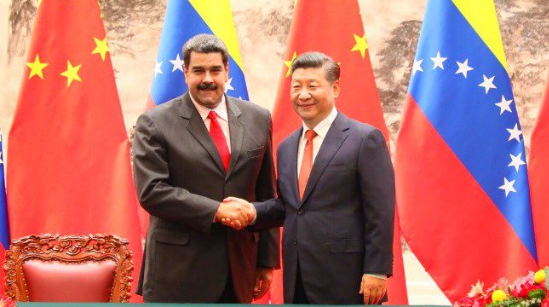

China this month agreed to extend $5 billion in credit to Venezuela as the South American country faces severe economic problems including hyperinflation and dire shortages of food, medicines and basic goods. Finance Minister Simón Zerpa announced the credit line as President Nicolás Maduro was departing for China to seek support amid the country’s crises. What did Maduro accomplish on his latest trip to Beijing? To what extent will support from China today help Venezuela stabilize its economy in the months ahead? How much is Venezuela relying on China, and at what are the risks for both countries in the mid to long term?

Asdrúbal Oliveros, director, and Guillermo Arcay, economist, at Ecoanalítica in Caracas: “On his latest trip to China, Maduro had two main goals in mind: securing an injection of fresh cash and delaying the capital amortization payments on Chinese debt. However, his demands were not met by Xi Jinping. Instead of fresh funds for discretional use, the Chinese president provided a new credit line of $5 billion that will be progressively disbursed over time, directly to oil and mining joint ventures between China and Venezuela. Regarding the provision of a new six-month grace period on capital amortization payments, Maduro’s wishes were entirely denied. The repercussions of Maduro’s failure on this trip are not trivial, as Venezuela needed to finance, somehow, a hard currency cash flow deficit of nearly $1.7 billion for this year’s fourth quarter, and an even larger one in 2019, expanded by the constant contraction of the country’s oil exports. The grace period was crucial. According to our estimates for this year’s fourth quarter, Venezuela will have to transfer around 374,000 barrels per day to China as debt service and will only sell around 358,000 barrels per day in other deals that actually generate cash. A grace period would more than double the government’s future available revenue and could amount to savings of approximately $2.3 billion in just three months, or $624 million more than needed to finance the external deficit. Next year, in the midst of a humanitarian, social and economic collapse, the government won’t have enough funds for a stabilization plan and will also have to either slash food and medicine public imports, default on Chinese and Russian debt or all of the above.”

Margaret Myers, director of the Asia & Latin America Program at the Inter-American Dialogue: “China may very well extend up to $5 billion in credit to Venezuela, but Chinese media have yet to confirm Venezuelan Finance Minister Simón Zerpa’s September statements. Zerpa also made mention of $5 billion in Chinese finance earlier this summer, and a draw of approximately $150 million to finance China-Venezuela exploration and production projects. If this deal materializes, it would be consistent with China’s most recent financing arrangements in Venezuela. Although overall Chinese finance to Venezuela has dwindled in recent years, Beijing has focused any new credit on boosting the country’s rapidly declining oil production. An approximately $2.2 billion loan in 2016 was earmarked for oil sector development, for example. This sort of credit is critical for Venezuela’s oil industry—PDVSA produced only 1.34 million barrels of oil per day in June, compared to an average of 2.15 million barrels per day in 2016, according to OPEC. It might also help to ensure repayment of China’s outstanding loans to the country, most of which are backed in oil, while increasing China’s footprint in the Orinoco Belt. But even if distributed all at once, a $5 billion infusion hardly amounts to a lifeline for the Maduro administration. Nor would it do much to help the Venezuelan people or to address rampant corruption and economic mismanagement. Another Chinese line of credit would be a very shortterm win for Maduro. Beijing, on the other hand, is playing the long game—especially as it concerns equity oil investment. Energy security calculations are still driving China’s foreign policy decision-making in Venezuela, it would seem.”

Ray Walser, retired U.S. Foreign Service officer and former Latin American policy analyst at the Heritage Foundation: “In his recent visit to Beijing, it appears President Maduro received the treatment accorded a legitimate head of state, including a coveted meeting with President Xi Jinping, a Chinese commitment to continue its ‘strategic partnership’ with Venezuela and the promise of badly needed economic support. While far from transparent, new Chinese resources will go to the petroleum and gas sector in hopes of reversing the precipitous decline in oil production. An additional $5 billion would add to an estimated $62 billion already committed by the Chinese to the Chávez-Maduro regime in the past decade. While certainly leery of the economic meltdown and widening humanitarian crisis in Venezuela, the Chinese forge ahead with a strategy of engagement that brings risks as well potential benefits. On the plus side, Venezuela loyally supports Chinese international undertakings such as the Belt and Road Initiative, continues to foster a combative spirit of anti-Americanism in the region’s beleaguered but still influential left and vexes U.S. policymakers in the era of President Trump. On the negative side are the dangers of debt default and non-delivery on commitments. China’s long-term focus on the petroleum industry will have enduring financial and legal consequences even if Maduro and company were to lose political power. Sales of Chinese military and police equipment also help strengthen the forces of repression. One can imagine that behind closed doors, the Chinese are less than thrilled with Maduro’s ham-handed and corrupt leadership. However, in public, it is a see-no-evil approach. Repairing the failures of democratic governance, even if it is a regional priority in the Americas, is not one of China’s strengths. Caught in a widening gyre of economic and political woes, the Maduro regime appears to be on life support. Without massive structural changes, a fresh infusion of Chinese cash will only have a palliative effect, further prolonging Venezuela’s national agony.”

The Latin America Advisor features commentary from leaders in politics, economics, and finance every business day. The publication is available to members of the Dialogue’s Corporate Program and others by subscription.

After a 7.0 magnitude earthquake struck Haiti, the aftershock reached China in ways that few anticipated.The earthquake forced Chinese leaders to navigate the tricky politics of disaster relief.

Hugo Chavez, the Venezuelan president, has clearly been enticed by the Libyan drama, where his longtime friend and ally, Muammar al-Qaddafi, is under siege from rebel forces.

Estimates of the volume, composition, and characteristics of Chinese lending to the region since 2005.

Venezuelan President Nicolás Maduro met last week with his Chinese counterpart, Xi Jinping, in Beijing.

Venezuelan President Nicolás Maduro met last week with his Chinese counterpart, Xi Jinping, in Beijing.