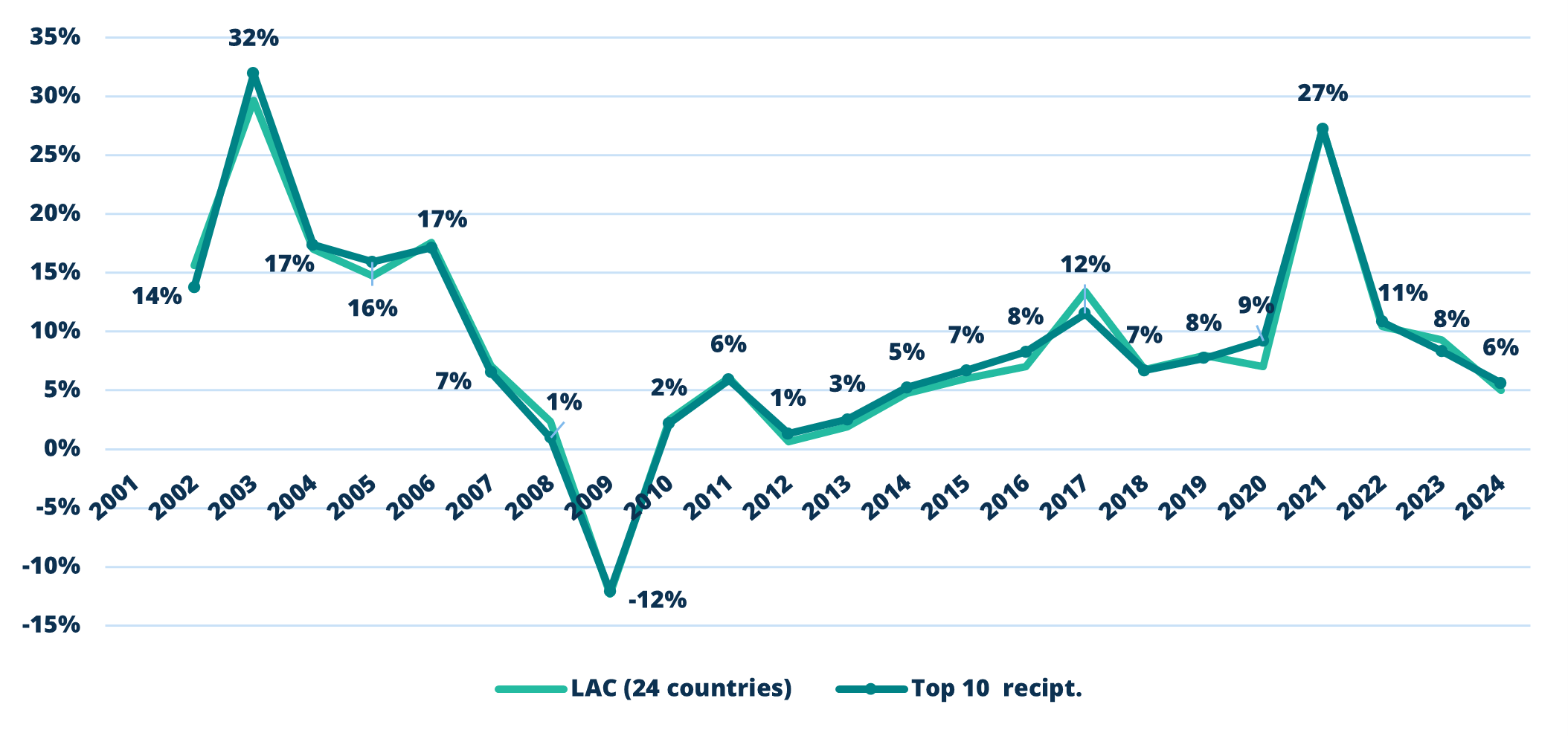

This briefing offers a descriptive perspective regarding remittance transfer growth in 2024. This year, flows will experience less than six percent growth. The memo highlights some insight on migration, historic growth, competition in the marketplace, and what growth can be expected for 2024.

Today, migration continues to be a social, political, and economic reality across the world – perhaps more intensely than before. As a result, migrants working in Dubai, Rome, and Los Angeles, among other cities, are sending record amounts of money home to their friends, families, and other loved ones. In 2023, roughly US$857 billion were sent in remittances across the globe[1] of which approximately US$160 billion went to Latin America and the Caribbean (LAC). Amounting to five percent of the region’s gross domestic product (GDP), these flows represent an economic lifeline to a region contending with state fragility, emigration, and global economic crises. In addition to exploring the migration patterns driving these flows, this note explores in detail the scale, composition, and nature of remittances.

FIGURE 1: REMITTANCE GROWTH IN LAC, 2001-2024

Source: Central Bank data

Migration Patterns Driving Growth

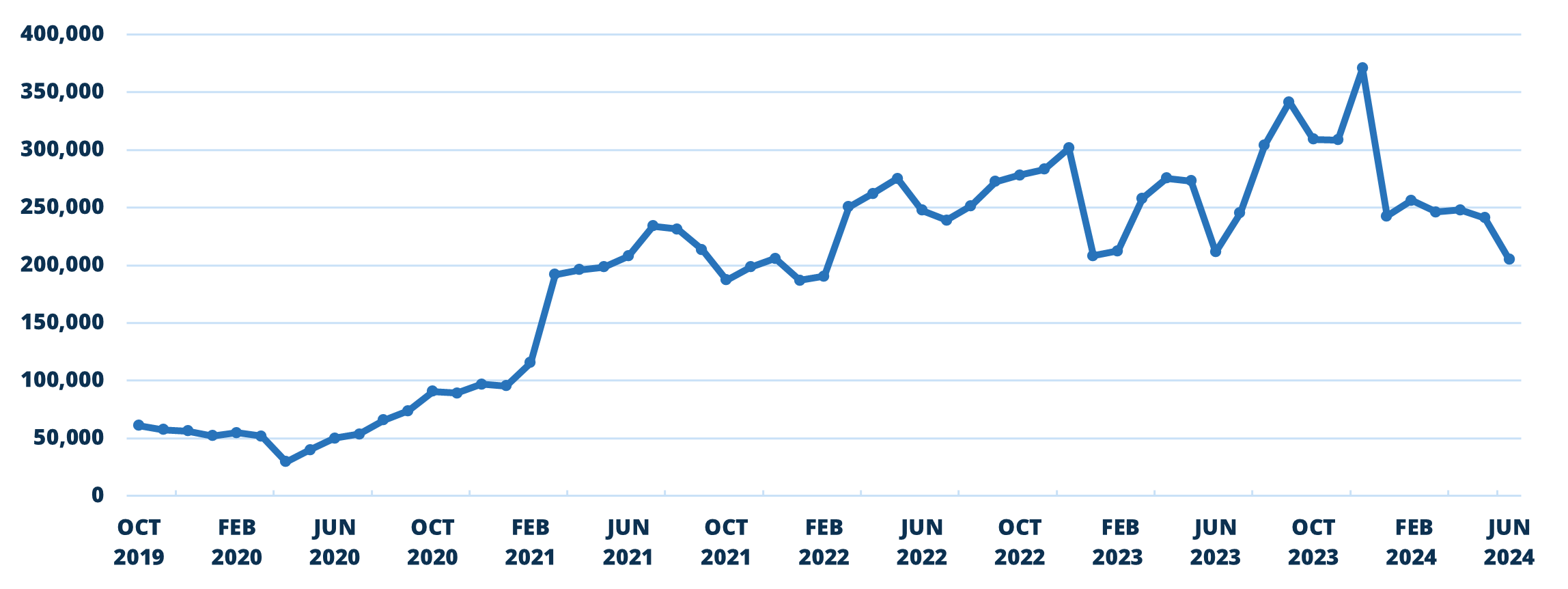

Last year, migration from LAC to the United States grew more than six percent from 36.9 million to over 45.3 million migrants living in the US. The US remains the destination for one out of five migrants worldwide[2] and, as a result, more migrants are being encountered across the country than at any other time in recent history.

The US will receive at least three million people by the end of this year, and border encounters as a share of the US population are expected to remain above 0.7 percent for the fourth straight year. For context, in the decade before the Covid-19 pandemic, this number hovered around 0.1-0.2 percent.

FIGURE 2: BORDER ENCOUNTERS AS A SHARE OF THE US POPULATION, 1991-2024

Source: Department of Homeland Security (DHS) National Encounters

Recent growth among migrants from LAC has come largely from fragile states experiencing social, political, or economic crises. These countries include Cuba, Haiti, Nicaragua, Venezuela, Guatemala, and Honduras. Following the heights reached by these countries post-pandemic, there has been a downward trend in encounters in the short-term.

Factors determining whether or not a person decides to migrate are complex and are the result of a mix of reasons. Among these are climatic, economic, social, aspirational, transnational, and political considerations. According to survey data in Northern Triangle countries and Nicaragua – which together represent an estimated 15 percent of all migration from LAC – the intention to migrate has reduced, roughly mirroring pre-pandemic levels.

FIGURE 3: US NATIONWIDE ENCOUNTERS, 2019-2024

Source: Department of Homeland Security (DHS) National Encounters

FIGURE 4: INTENTION TO MIGRATE IN CENTRAL AMERICA, 2019-2024

Source: Survey data collected by author.

While migration appears to be showing signs of slowing[3], migration to the US is continuing at record levels and will continue to positively impact remittance volumes sent back to the region. As a result, the US will remain the top remitting country to LAC for the foreseeable future. Over 80 percent of remittances sent to the region originate in the US, while 17 percent come from Europe and the rest of the world, and three percent are intraregional remittances.

Current Remittance Trends

Future flows of remittances for the next five years will likely show similar characteristics albeit at a slower pace. The following sections explore current remittance trends from 2023 and 2024 in order to draw conclusions regarding estimates for the future. In general, the scale, composition, and nature of remittances in LAC have all changed since 2020.

Scale

As aforementioned, remittances to LAC have grown by over nine percent from US$146 billion in 2022 to US$160 billion in 2023. Last year, the top 10 remittance receiving countries received US$142 billion growing by over eight percent in 2023. Based on trends so far this year, these countries will see 5.5 percent growth totaling an estimated US$150 billion received in 2024.

Lastly, remittances volumes for all countries to the region are estimated to increase 5.1 percent in 2024 to US$168 billion.

At the country level, the highest year over year (YoY) growth rates seen in 2023 were in Nicaragua (51 percent), Cuba (33 percent), and Argentina (18 percent). In general, since 2020, the highest YoY growth rates have been seen in countries experiencing political crises or other forms of political conflict. This pattern is illustrated in the table below with the clear exception of Haiti, where remittances have only grown one percent between 2020 and 2023.

TABLE 1: REMITTANCE VOLUME GROWTH LEVELS, 2001-2023

|

Country |

2001-2005 |

2005-2010 |

2010-2015 |

2015-2020 |

2020-2023 |

|

Cuba |

3% |

2% |

4% |

-16% |

43% |

|

Nicaragua |

13% |

6% |

8% |

9% |

27% |

|

Argentina |

18% |

8% |

-5% |

6% |

23% |

|

Venezuela |

2% |

17% |

|||

|

Guatemala |

37% |

7% |

9% |

12% |

15% |

|

Honduras |

24% |

8% |

7% |

9% |

14% |

|

Mexico |

18% |

-1% |

4% |

9% |

12% |

|

Ecuador |

12% |

1% |

-2% |

7% |

11% |

|

Colombia |

10% |

4% |

3% |

8% |

10% |

|

Peru |

14% |

12% |

1% |

1% |

9% |

|

Panama |

12% |

26% |

6% |

-7% |

9% |

|

Brazil |

14% |

2% |

-1% |

4% |

9% |

|

El Salvador |

9% |

3% |

4% |

7% |

8% |

|

Bolivia |

20% |

23% |

4% |

-1% |

7% |

|

Costa Rica |

16% |

5% |

1% |

-2% |

7% |

|

Guyana |

55% |

13% |

-4% |

7% |

6% |

|

Dominican Republic |

7% |

7% |

6% |

10% |

6% |

|

Suriname |

81% |

2% |

9% |

79% |

5% |

|

Belize |

9% |

12% |

2% |

7% |

5% |

|

Jamaica |

11% |

3% |

3% |

5% |

4% |

|

Uruguay |

562% |

10% |

-6% |

4% |

4% |

|

Trinidad and Tobago |

18% |

0% |

11% |

5% |

2% |

|

Paraguay |

3% |

21% |

6% |

1% |

2% |

|

Haiti |

10% |

8% |

8% |

8% |

1% |

|

LAC (24 countries) |

15% |

3% |

4% |

11% |

11% |

|

Top 10 recipt. |

15% |

3% |

4% |

11% |

11% |

Source: Central Bank data.

Composition

Total transactions in the region are estimated to surpass 45 million within the next five years, up from 41.4 million in 2023. These transactions are largely initiated from the United States by migrant workers sending payments home. Seventy-three percent of person to person (P2P) are estimated to be taking place from the US, 18 percent are from Europe and the rest of the world, while nine percent are intraregional transactions. A smaller, but noteworthy amount of transactions is attributable to business to business (B2B) and person to business (P2B) transfers.

The monthly average principal for nearly every one of the top 10 remittances receiving countries has increased significantly since 2020. This is partly due to global inflationary trends as well as increases in remittance frequency. In other words, migrants are remitting more money, more often, remitting two to three times more a year in 2024 than they did in 2020. Annually, migrants are sending home roughly US$4,076 in annual principal. This principal is larger if the sender is sending from the United States (US$4,463) than senders in LAC (US$843) or elsewhere (US$3,968).

Last year’s global market share distribution found 12 percent of remittances were serviced by Western Union, followed by Remitly (four percent), Intermex, MoneyGram, and Ria (three percent) and Viamericas (1.5 percent). In addition, digital remittance transactions to LAC are steadily increasing and are projected to reach over 45 percent of total transactions by 2030. Of the total digital market (36 percent), Remitly captures the most at 19 percent, Western Union captures six percent, while MoneyGram and Ria (Euronet) together capture three percent. Other companies together capture roughly eight percent (five percent coming from Paypal’s ‘Xoom’). Adoption of digital remittance services has been assisted by improvements in mobile payments technology and systems as well as the increased digitization of the economy at large. However, migrants still largely use conventional, in-person remittance methods.

While preference, trustworthiness, and convenience color the debate on digital transfers among RSPs, over 62 percent of senders are still choosing to use in-person methods. While regional payment system innovations like cryptocurrencies or Central Bank Digital Currencies (CBDCs) promise to expand digital options for migrants sending remittances back home, their success will depend on various factors such as successful “off-ramps” for currency use as well as the purchasing power and wealth diversification capacity of migrants.

FIGURE 5: DIGITAL REMITTANCE MARKET IN LAC, 2016-2032

Source: Author estimates based on remittance service provider (RSP) data.

Nature

In 2024, remittances continue to grow as a function of migration. This is more visible in the relationship between border encounters from eight nationalities (Colombia, Ecuador, El Salvador, Guatemala, Haiti, Honduras, Mexico, and Nicaragua) that capture over 80 percent of the flows to LAC. This growth can be best seen in Nicaragua and Haiti where remittances increased as a result of the worsening of their political crises in both countries since 2021.

FIGURE 6: BORDER ARRIVALS AND REMITTANCE TRANSFER VOLUME, 2019-2024

Source: Central Bank and DHS. Log values are utilized to control for country differences in volume and border arrivals.

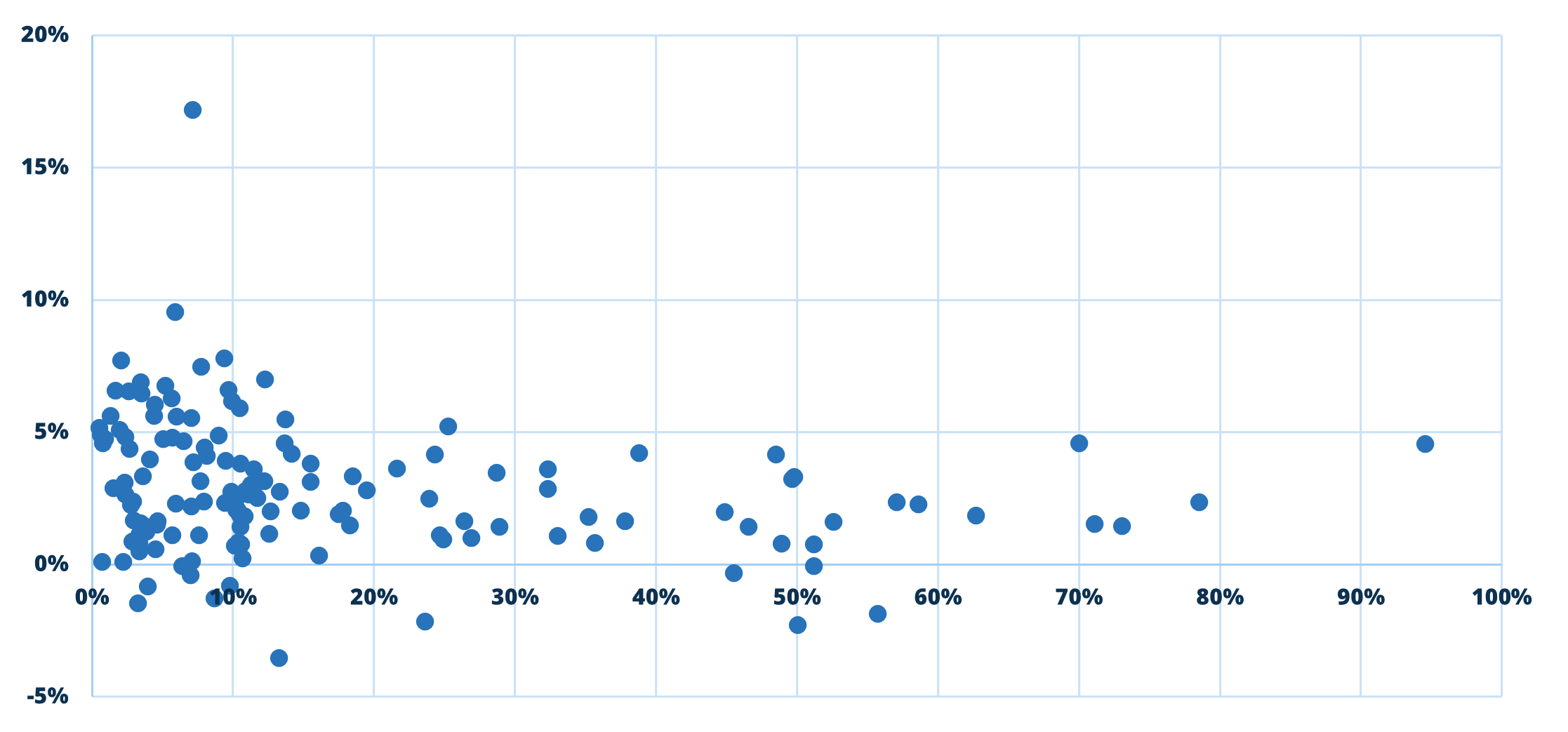

In the near future, remittance growth will resemble periods before the Covid-19 pandemic, as the demographic factors driving post-pandemic growth are no longer present. For example, once a migrant population reaches roughly 17-20 percent of the origin countries’ population, emigration and remittances tend to decrease. Emigration decreases because more socioeconomic pressures are placed on mobility-prone populations and there is more pressure to stay put. As a result of this decrease in migration, changes in remittance growth tend to follow. After the diaspora reaches 20 percent, for each one percent increase in migration, there is 2.7 percent less emigration.

FIGURE 7: MIGRANTS AS A SHARE OF POPULATION AND ANNUAL MIGRATION GROWTH

Source: UNDESA

Nonetheless, growth is continuing as a result of migration. For example, within the Central American migrant community, over 70 percent of this population sends remittances home. As a result, any increase in the migrant population necessarily yields new senders who expand the pool of those already sending money back home. The number of senders is likely to diminish due to a combination of factors, including enforcement actions and demographic growth.

Migration, however, is not the only factor that affects remittance volumes. The economy in the US or other host country affects the principal sent as well. While unemployment rates have remained historically low and the post-pandemic economy in the US has been characterized by a labor shortage (a pull factor for migration), monetary tightening by the Federal Reserve System may have effects on employment in the short term. Therefore, average remittance sending will remain below three percent per year due to an expected rise in unemployment and post-pandemic cost of living increases.

Future Flows of Remittances

By the end of 2024, the LAC region will see remittance growth rates of not more than six percent.

The top 10 remitting countries, for their part, will see more muted growth at five percent. According to our projections, Peru (14 percent), Nicaragua, and Haiti (both 13 percent) will see some of the highest YoY growth rates, Colombia, Ecuador (both 10 percent), and Guatemala (nine percent) will continue to show strong growth, while other countries measured will show growth either on par with, or below, the region.

As discussed above, increases in remittances will continue to be influenced by migration largely to the US. The intention to migrate is a strong sentiment and is reflected in aspirational issues of modern society. Regardless of policy interventions relating to migration, people will continue to find ways to migrate. Specifically, in Central America, growth will stand at five percent annually for the next three years and represents a return to pre-pandemic levels. Negative economic factors will also continue to blunt remittance volumes sent in the years ahead as migrants face down the macroeconomics of inflation in the US.

TABLE 2: LAC REMITTANCE VOLUMES, 2021-2024

|

Country |

2021 |

2022 |

2023 |

2024 |

|

Argentina |

$739,802,367 |

$776,792,486 |

$1,500,000,000.00 |

$1,680,000,000 |

|

Belize |

$141,199,835 |

$148,259,826 |

$152,707,621.25 |

|

|

Bolivia |

$1,386,915,536 |

$1,456,261,312 |

$1,500,000,000.00 |

|

|

Brazil |

$4,172,476,743 |

$4,381,100,580 |

$4,937,500,353.85 |

|

|

Colombia |

$8,597,240,000 |

$9,416,242,000 |

$10,043,426,214 |

$11,047,768,835 |

|

Costa Rica |

$585,000,000 |

$614,250,000 |

$651,105,000 |

|

|

Cuba |

$1,164,734,554 |

$1,222,971,282 |

$2,458,459,584 |

|

|

Dominican Republic |

$10,402,469,200 |

$9,856,497,461 |

$10,212,164,230 |

$10,722,772,441 |

|

Ecuador |

$4,362,384,920 |

$4,624,128,015 |

$5,044,335,428 |

$5,573,990,647 |

|

El Salvador |

$7,517,140,000 |

$7,855,411,300 |

$8,187,025,042 |

$8,465,383,893 |

|

Guatemala |

$15,295,685,200 |

$18,507,779,092 |

$19,789,951,500 |

$21,571,047,135 |

|

Guyana |

$422,643,846 |

$443,776,039 |

$452,651,559.35 |

|

|

Haiti |

$3,655,760,565 |

$3,316,282,132 |

$3,440,332,855 |

$3,853,172,797 |

|

Honduras |

$7,372,054,100 |

$8,477,862,215 |

$9,399,378,206 |

$9,775,353,334 |

|

Jamaica |

$3,630,755,394 |

$3,521,832,732 |

$3,486,977,481 |

$3,521,847,255 |

|

Mexico |

$51,585,680,000 |

$58,502,781,700 |

$63,739,089,821 |

$65,651,262,515 |

|

Nicaragua |

$2,146,900,000 |

$3,224,900,000 |

$4,877,635,000 |

$5,511,727,550 |

|

Panama |

$533,183,317 |

$559,842,483 |

$576,637,758 |

|

|

Paraguay |

$562,946,537 |

$591,093,864 |

$621,000,000 |

|

|

Peru |

$3,607,625,054 |

$3,707,556,166 |

$4,121,948,437 |

$4,657,801,733 |

|

Suriname |

$607,293 |

$637,658 |

$656,788 |

|

|

Trinidad and Tobago |

$208,279,026 |

$218,692,977 |

$224,160,302 |

|

|

Uruguay |

$129,538,295 |

$136,015,210 |

$139,415,590 |

|

|

Venezuela, RB |

$3,998,610,229 |

$4,198,540,740 |

$4,618,394,814 |

|

|

LAC (24 countries) |

$132,219,632,011 |

$145,759,507,270 |

$160,174,953,582 |

$168,288,701,264 |

|

Top 10 recipt. |

$118,173,694,433 |

$131,011,272,814 |

$142,342,264,212 |

$150,352,128,140 |

Source: Central Bank data

FIGURE 8: ANNUAL MIGRATION FROM CENTRAL AMERICA, 2018-2027

Source: DHS Statistics

For more detailed information, additional data, and analysis please consult the following presentation

Endnotes

[1] “Migration and Development Brief 40 – Remittances Slowed in 2023, Expected to Grow Faster in 2024.” World Bank Group and KNOMAD. June 2024. https://knomad.org/publication/migration-and-development-brief-40

[2] UNDESA, 2025 projections based on entry to the US

[3] Orozco, Manuel and Patrick Springer. “An Unprecedented Migration Crisis: Characterizing and Analyzing its Depth” Inter-American Dialogue. November 28, 2023. https://thedialogue.org/analysis/an-unprecedented-migration-crisis-characterizing-and-analyzing-its-depth/

This briefing, and accompanying presentation, are products of the Remittance Industry Observatory (RIO) at the Inter-American Dialogue.